Article about net salary and taxes in Sweden

Article about net salary and taxes in Sweden

Welcome to ForTravelLovers.com, where you will find all the information you need about calculating net salary and taxes in Sweden. In this article, we will provide you with relevant data, calculators and analysis related to taxes in Sweden, as well as information about salaries in this country and the possibility of saving money by working there. We will also address the problem of pensions in Sweden. Read on to get answers to all your questions!

1. Calculation of net salary and taxes in Sweden

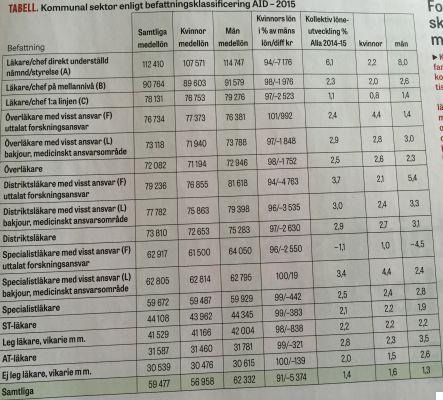

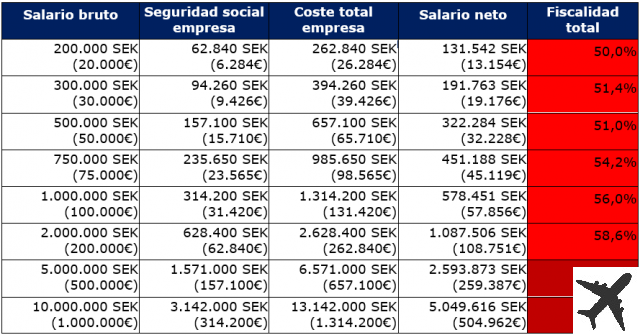

If you are interested in working in Sweden, it is important that you understand how your take-home pay is calculated and how much tax you will need to pay. In Sweden, the tax system is progressive, meaning that the more you earn, the more taxes you will pay. To calculate your net salary, you must subtract taxes and social contributions from your gross salary.

What are taxes and social contributions in Sweden?

In Sweden, taxes are divided into three main categories: income tax, municipal tax and social contributions. Income tax varies depending on your income and can range between 29% and 57%. Municipal tax is an additional percentage that varies depending on the city in which you live. Social contributions include unemployment insurance, sickness insurance and pension insurance.

Where can I find a net salary calculator in Sweden?

If you want to calculate your net salary in Sweden accurately, we recommend using an online calculator. There are several tools available on the Internet that allow you to enter your gross salary and get an estimate of your net salary after taxes. Some popular options include Kalkylera nettolön and Lön efter skatt. These calculators will help you have a clear idea of how much money you will receive each month.

2. Salaries in Sweden and the possibility of saving money

One of the attractions of working in Sweden is the level of salaries, which are generally high compared to other countries. However, it is also important to take into account the cost of living in Sweden, which can be high. Despite this, it is possible to save money working in this country if expenses are properly managed and savings opportunities are taken advantage of.

How much can you save working in Sweden?

The amount you can save by working in Sweden will depend on several factors, such as your salary, your monthly expenses and your saving habits. It is important to note that the cost of living in Sweden can be high, especially in large cities like Stockholm. However, there are also social benefits and savings opportunities, such as the pension system and subsidized housing programs, that can help you save money in the long term.

What are the best ways to save money in Sweden?

To save money in Sweden, it is important to have a clear budget and control your monthly expenses. In addition, you can take advantage of the savings opportunities that the country offers, such as the pension system, which allows you to save for the future. You can also look for subsidized housing or share an apartment to reduce housing costs. Other ways to save include using public transportation instead of owning your own car and taking advantage of deals and discounts at stores and restaurants.

3. Pension problem in Sweden

The pension system in Sweden has been the subject of debate in recent years due to demographic changes and an aging population. The current system is based on a pay-as-you-go system, where active workers finance the pensions of retirees. However, with life expectancy increasing and the birth rate decreasing, there are concerns about the long-term sustainability of the system.

What are the measures being taken to address the pension problem in Sweden?

The Swedish government has implemented several measures to address the pension problem. These include increasing the retirement age, adjusting pension benefits according to life expectancy, and promoting private savings through individual pension plans. In addition, efforts are being made to encourage labor participation among younger groups and improve gender equality in the labor market, which will help ensure the long-term sustainability of the pension system.

Conclusion

In summary, calculating net salary and taxes in Sweden is an important aspect to consider if you are interested in working in this country. It is essential to understand how your take-home pay is calculated and how much taxes you will have to pay. Additionally, it is possible to save money working in Sweden by properly managing expenses and taking advantage of savings opportunities. Finally, the pension problem in Sweden is being addressed through measures such as raising the retirement age and encouraging private savings. We hope this article has been useful in answering your questions!

Frequently Asked Questions (FAQs)

1. What is the income tax rate in Sweden?

The income tax rate in Sweden varies depending on your income and can range from 29% to 57%. This percentage is applied progressively, which means that the more you earn, the more taxes you will pay.

2. What are the savings opportunities in Sweden?

In Sweden, there are several savings opportunities, such as the pension system, which allows you to save for the future. You can also look for subsidized housing or share an apartment to reduce housing costs. Other ways to save include using public transportation instead of owning your own car and taking advantage of deals and discounts at stores and restaurants.

Until next time,

The ForTravelLovers.com Team