Take all your doubts about your credit card travel insurance. Find out if you already have this benefit and how it works in practice.

Have you ever heard that you can buy travel insurance with your credit card? Know that this is really true, but not every card offers this benefit. In addition to each flag has its own conditions of use.

So if you have a trip planned and you still don't know which travel insurance to choose, just paste with us in this post and clear all your doubts about it. Find out if your card has this benefit and how it works at the time of the squeeze.

Compare coverage, prices and benefits with a Travel insurance and see if it's worth hiring this service for your next adventure.

Prepared? Then just scroll the screen:

In this post you will see:

- What is credit card travel insurance

- How do I know if my credit card offers travel insurance?

- Who is entitled to credit card travel insurance?

- How much does credit card travel insurance cost?

- Is credit card travel insurance worth it?

- How does credit card travel insurance work?

- What does credit card travel insurance cover?

- How to activate credit card insurance

- Which is better: international travel insurance or credit card travel insurance?

- Why buy travel insurance?

- Where to buy travel insurance

- How much does traditional travel insurance cost?

- insurance discount coupon

- What are travel insurance coverages?

- Frequently Asked Questions

What is credit card travel insurance

Travel insurance offered by credit cards is a benefit that covers certain medical expenses during the trip and, in some cases, also offers insurance for flight delay or cancellation, as well as for the protection and loss of luggage. For this, however, the air ticket must be purchased on the card, in order to validate the days that the insurance must cover.

This is a no-cost benefit that varies in coverage and policy by card type and brand.

How do I know if my credit card offers travel insurance?

If you want to find out if your credit card offers this function, just check the brand's website, that is: Visa, Mastercard, American Express, Elo, and so on.

In some cases it is possible that even the bank itself can provide the insurance, as is the case with Nubank customers, for example. The bank has an exclusive partnership with the insurance company Chubb, which allows for a much more economical price and a more complete coverage than that offered by other credit cards.

This option has insurance for national or international travel, covering medical and dental expenses, contamination by coronavirus, lost luggage, trip cancellation, accommodation for a companion and other services. Thus, it is a good example that it is worth checking what your bank offers and then comparing it with other insurance available on the market.

Who is entitled to credit card travel insurance?

It is important to keep in mind that this benefit is generally available to customers who enjoy a higher category of card. This is the case for Platinum, Black, Gold, Infinite customers, etc. See below the main flags and their respective categories:

Mastercard credit card

The flag's customers Mastecard who have a Platinum or Black credit card are entitled to travel insurance. However, the insurance is only valid for international trips lasting a maximum of 31 days.

Visa credit card

Those who use the brand's credit cards Visa must be a Platinum, Signature, or Infinite customer. Travel insurance is also only valid for international trips lasting, in this case, up to 60 days.

American Express Credit Card

All customers of American Express, flag issued here in the Spain by Santander and Bradesco banks, are eligible for free travel insurance. Some of the coverages offered include flight delay, emergency medical expenses, purchase protection, and more.

Elo credit card

Another brand that also provides travel insurance as a benefit is Elo in the Diners Club, Nanquin Diners Club, Nanquin and Graphite categories. Your insurance covers loss of luggage, flight delay or cancellation, and medical and hospital expenses.

How much does credit card travel insurance cost?

Credit card travel insurance is offered at no cost to the customer. Just buy the air ticket using the card to choose whether or not to use this benefit.

Is credit card travel insurance worth it?

It depends. Looking at the financial issue, it is certain that you will not find cheaper travel insurance than the one offered for free by your credit card. However, the coverage offered by it is much simpler compared to travel insurance from an insurance company.

So when traveling to Europe, for example, it is important to verify that the card's insurance covers medical expenses with an amount of at least 30 thousand euros - since this is the minimum amount required by the Schengen Treaty in force in about 20 countries in the region.

Another important point to pay attention to are the other services offered on the card, such as insurance for lost luggage, flight cancellation, coronavirus coverage, legal assistance, dental insurance, pharmaceutical reimbursement, among others. These are just a few examples of the type of insurance offered by insurers that is not always possible to find in credit card insurance.

Both types of insurance have their advantages, so it's really worth comparing the best options, both from the card and from the insurers, according to you. In other words, are you pregnant? Are you going to practice extreme sports on any itinerary? Are you over 60? All these questions can help you choose the best insurance for your trip.

How does credit card travel insurance work?

Credit card travel insurance only works from the moment you buy an air ticket on the card and enable this function for the days you are out of the country. Each flag has its own conditions and requirements, so it's worth checking their official websites for what you need to assess.

In some cases, credit card insurance extends to people traveling with you, such as spouses and family members. But it's not every flag, so again: you have to check it out.

Most of the flags work with reimbursement, which means that after the service occurred during the trip, the credit card will reimburse you for the expenses. Even so, it is necessary to investigate on a case-by-case basis, as there are options in which the insured person is sent to the nearest clinic or hospital without needing him to spend even a penny for this.

Basically, credit card travel insurance works as a international travel insurance, covering medical and hospital expenses, as well as, in some cases, insurance for flight cancellation and lost luggage. However, it does not offer as many services as international insurance usually does.

What does credit card travel insurance cover?

As mentioned above, travel insurance coverage and service conditions will depend on each credit card brand. Even so, it is possible to highlight the main equivalent services offered on most cards:

- international health insurance (medical-hospital expenses)

- Lost luggage insurance

- Flight cancellation insurance

The coverage offered by the credit card itself is not always the best option for your trip. Therefore, it is very important to read the coverage and the terms and conditions of the insurance that is offered.

How to activate credit card insurance

If you need to activate your credit card travel insurance, just contact your flag center and ask for directions. This can be done via call, or in some cases, online at the insured's portal.

It is extremely important that, at the beginning of the trip, you have at hand, or easily accessible, all the insurance policy data, containing contact details in case of an emergency: insurance company phone number, website, etc.

Which is better: international travel insurance or credit card travel insurance?

The ideal is always to travel with travel insurance, be it a credit card or an insurance company.

Each type will provide unique benefits and perks that may or may not be just what you need. That's why it's so important to read the clauses of each insurance and find out if your type of trip will be covered.

We, at Dicas de Viagem, usually opt for traditional travel insurance, both for national and international trips. This is because, in addition to being the option with the greatest coverage, we can use a online insurance comparator where it is possible to pay attention to each type of service, comparing side by side with other options. That way it is much simpler to find out which is the ideal insurance.

What other types of travel insurance are there?

There are insurances for the most varied styles of travel. Below we've listed the most common types, and you can read more about them in our in-depth guides that better describe the particulars of each.

- international travel insurance

- national travel insurance

- Maternity travel insurance

- cruise travel insurance

- Multi trip travel insurance

- Multi-destination travel insurance

- annual travel insurance

- Long term travel insurance

- interchange travel insurance

- student travel insurance

In addition, we also have complete guides to answer all your questions about family travel insurance, group travel insurance of excursion and until honeymoon travel insurance.

Check all travel insurance options.

Why buy travel insurance?

Insurance is an essential item for your trip, whether national or international. So, if you don't have one of the credit cards listed in the categories we mentioned at the beginning of the text, then you need to buy travel insurance before you leave.

Regardless of the purpose of your trip, it is the insurance that will guarantee tranquility and safety throughout the itinerary. Furthermore, in some countries, it is mandatory to enter the nation. This is the case of the countries that are part of the Schengen Treaty, in Europe, or of the Australia, Cuba, among others.

And even in countries where hiring is not mandatory, it is highly recommended. After all, unforeseen events happen to anyone, and at the time of an emergency, travel insurance will cover all expenses and help you with the necessary information on where to go, what to do, how to do it, etc. ?

Where to buy travel insurance

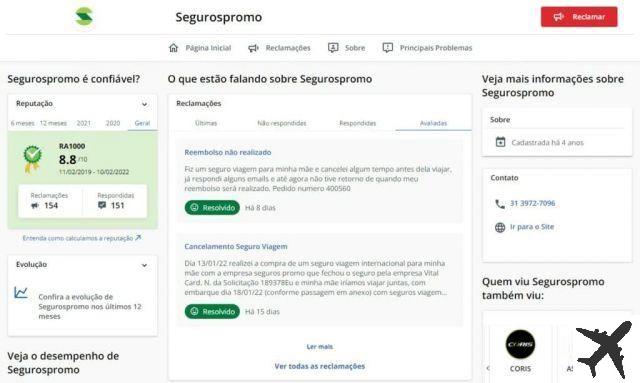

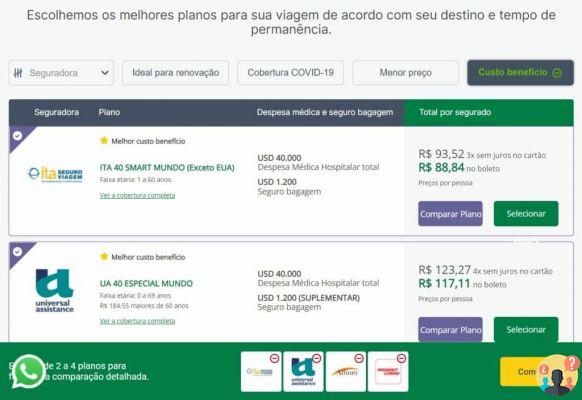

Buying travel insurance is very simple and you can do it online. A highly recommended insurance comparator is Promo insurance, a site that we trust and that offers all the information on the best plans on the market to help you make your choice.

Right on the home page, select the continent of destination, enter the departure and arrival dates, fill in your name, your email, your telephone number and click on “search travel insurance".

You will be directed to a list of available insurance for the destination. To use the comparator, choose from two to four plans and select the option “compare plan“. Then click on the “compare“ on the lower right side of the screen. Ready! Now you can see the advantages of each insurance side by side to make a decision and finalize the purchase.

After hiring, you receive your travel insurance policy by email. Keep this document well, as it contains the general conditions of the contracted plan and all the information on how to call the insurance company in case of an emergency.

So, if there is any eventuality on the trip, you can contact the insurance company via phone, WhatsApp, online chat or email. All contact numbers and forms are available on the policy – so keep the document in an easily accessible place.

It is also worth remembering that all insurers listed in the Promo insurance 24/7 support and fully in Portuguese. That is, even if you are in France, don't worry, the service will be super easy!

Check all travel insurance options.

How much does traditional travel insurance cost?

It is possible to buy good travel insurance for prices from R$ 6 to 10 per day, on average. You can even use the online insurance comparator to check available plans.

The amount of insurance may vary depending on the person who hires the service or the activities you intend to do at the destination. For example, an elderly person will have slightly more expensive travel insurance than a 20-year-old, and an athlete who practices extreme sports while traveling will also have a higher plan.

Insurance is, in general, very cheap and well worth it because it gives you the security of having a smooth trip, without worrying about how to deal with an emergency – just activate the insurance and it will take care of you.

Also, a good tip is to pay attention to the travel insurance on sale that take place throughout the year and at different times. It's always possible to get an even bigger discount! ?

Check all travel insurance options.

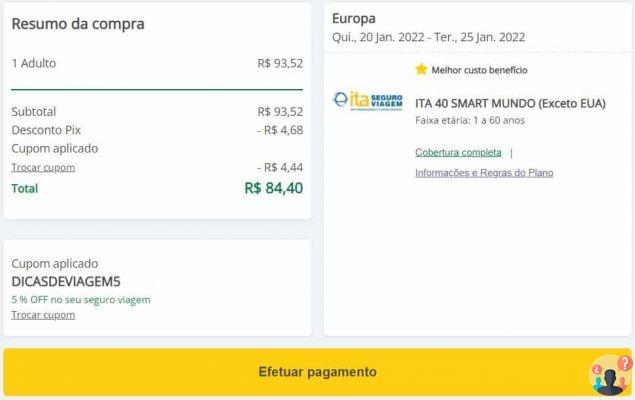

insurance discount coupon

Better than being covered against possible emergencies during the trip, it is better to hire insurance at the best price on the market. For this, Travel Tips readers can use the coupon FORTRAVELOVERS and guarantee 5% off the final price. Too much, huh?

Oh, and there is an additional 5% discount for those who pay with boleto, pix or transfer, and these discounts are cumulative. In other words, you can guarantee savings of up to 10% when purchasing your travel insurance. Also remembering that the purchase of insurance can be paid in up to 12 installments, making payment as easy as possible.

- Click to redeem coupon FORTRAVELOVERS and get 5% off

- Pay by boleto, Pix or wire transfer to earn an extra 5% and reach the 10% off!

What are travel insurance coverages?

Travel insurance usually covers some items on a standard basis, such as medical emergencies, hospital emergencies or compensation for lost luggage. But there are more comprehensive plans, varying according to the company, the type of insurance chosen, among other details.

If you have a problem in traffic, for example, you can count on travel insurance too. This is guaranteed if you hire travel assistance that even has legal support. It all depends on the insurance you choose, which can be simple or complete.

The most common occurrences that travel insurance covers are:

- 24-hour medical, hospital or dental care on international trips

- Sanitary repatriation

- medical transfer

- Body transfer and coverage for death while traveling

- Total disability due to accident while traveling

- Legal/financial assistance

- Death or serious illness of a family member

There are also some extra coverages that you can purchase with travel insurance:

- Support for Covid-19 and Pandemics

- trip cancellation

- Early return due to accident

- Expenses for misplaced, lost or damaged luggage

- Accidents in extreme sports

- flight delay

- Pregnant

Check all travel insurance options.

Did you like the credit card travel insurance tips? Comment here!

Frequently Asked Questions

What is credit card travel insurance?Credit card travel insurance is a benefit that covers certain medical expenses during the trip and, in some cases, also offers insurance for flight delay or cancellation, as well as for the protection and loss of luggage. Check out more details about credit card travel insurance.

How does credit card travel insurance work?Credit card travel insurance only works from the moment you buy an air ticket on the card and enable this function for the days you are out of the country. Each flag has its own conditions and requirements, so it's worth checking their official websites for what you need to assess. DISCOVER MORE.

Is it worth using credit card travel insurance?It depends. O credit card travel insurance it is cheaper than regular international travel insurance, for example. However, it also offers fewer benefits and services than other types of insurance. So what's really worth it is comparing the best options, both from the card and from the insurers. see how compare travel insurance.

How much does credit card travel insurance cost?Credit card travel insurance is offered at no cost to the customer. Just buy the air ticket using the card to choose whether or not to use this benefit. understand more about credit card travel insurance.

Which credit cards offer travel insurance?The flag's customers Mastecard who have a Platinum or Black credit card are entitled to travel insurance. Those who use the brand's credit cards Visa must be Platinum, Signature, or Infinite. All customers of American Express are eligible for free travel insurance. And another flag that provides the insurance is Elo in the Diners Club, Nanquin Diners Club, Nanquin and Graphite categories. Know more details.

What does credit card travel insurance cover?The main services offered by most credit cards are:

international health insurance (medical-hospital expenses);

Lost luggage insurance;

Flight cancellation insurance… Continue reading.